Scale Your Insurtech Growth with HubSpot Implementation

HubSpot is a powerful growth engine for Insurtech companies, but only when set up for success. At Digital Star, we specialize in helping Insurtech and insurance innovation companies transform HubSpot into their operational hub for marketing, sales, and customer retention.

You’ll get a clear, custom-built HubSpot setup that aligns your CRM, marketing automations, sales pipelines, and customer onboarding, so you can confidently scale your insurance technology business without bottlenecks or confusion.

Ready for a clear path to growth? Connect with Digital Star’s CEO Alex Moura today.

Case Study: Insurtech startup supercharges growth with consulting and marketing

Winning in the New Age of Insurance with HubSpot

Successful Insurtech businesses know that a CRM should do much more than track contacts and sales. With HubSpot set up right from the start, your team can focus on turning connections into conversions automatically while navigating the unique complexities of the insurance technology landscape.

Our HubSpot services help you build a CRM that doesn’t just track contacts but leverages your data to drive meaningful interactions and efficient workflows tailored specifically for Insurtech companies. Here’s what sets Digital Star Marketing apart:

Custom Integration: Seamlessly integrate HubSpot with your existing tech stack and workflows.

Automated Workflows: Set up workflows to automate follow-ups, lead nurturing, broker engagement, and task assignments specific to insurance sales cycles.

Pipeline Management: Tailored pipelines that align with your insurance sales process and track deals at every stage, from quote to policy activation.

Real-Time Reporting: Keep a close eye on metrics with custom dashboards and reports designed for Insurtech KPIs like policy conversion rates, agent performance, and customer lifetime value.

User Training & Support: Detailed training guides and ongoing support to empower your Insurtech team with HubSpot best practices.

Vertical Insurtech Growth: Specialized CRM setups and workflows tailored specifically to your insurance technology niche, whether you’re in commercial insurance, P&C, life insurance, or embedded insurance.

Breeze (Real-Time TAM Tracking): Identify insurance companies and brokers visiting your site, measure market penetration in the insurance industry, and proactively engage high-value prospects.

AI & Automation Trends: Utilize HubSpot’s AI-powered predictive lead scoring to prioritize insurance leads, improve conversion rates, and accelerate your sales process in the competitive Insurtech market.

Clean CRM Organization: Keep insurance partnerships, broker relationships, enterprise prospects, and policyholders clearly segmented to avoid data clutter and confusion, enabling your team to act with precision.

Let’s have a chat to find out if we can partner up and help you win more business in the Insurtech space. We only work with clients we know we can help substantially.

The SaaS Guide to HubSpot

The Insurtech Guide to HubSpot

Ready to learn everything you need to know to leverage HubSpot for Insurtech growth? Just like launching a new insurance product, the better you define your vision from the start, the more effective your HubSpot setup will be.

Whether you’re working with an agency like Digital Star or setting up HubSpot yourself, this guide helps ensure your HubSpot account becomes an engine for Insurtech growth, not just another CRM for insurance companies.

Why HubSpot Strategy Matters for Insurtech

HubSpot isn’t just a tool—it’s a platform that connects marketing, sales, and customer service in one ecosystem. In Insurtech, where data accuracy, compliance, and efficiency are paramount, you need HubSpot to align teams, streamline broker onboarding, and drive policyholder retention. A successful HubSpot setup isn’t just for managing leads; it’s about enabling growth in the insurance technology sector, creating connections with insurance partners, and driving measurable results.

When your HubSpot account is poorly managed (and let’s face it, many insurance technology companies struggle with this), it can become a bottleneck rather than a growth driver. Missed workflows, cluttered policyholder data, and disconnected teams can lead to friction that’s hard to overcome in the fast-paced Insurtech environment.

A strong HubSpot strategy, though, can help you keep insurance partners engaged, grow your Insurtech brand, and streamline operations, ultimately leading to higher retention and improved ROI in the competitive insurance innovation market.

When is it Time for Insurtech Teams to Review Their HubSpot Setup?

Insurtech growth is rapid, and change is constant. With new insurance products launching frequently, regulatory requirements evolving, and shifting distribution channels, a standard HubSpot setup quickly becomes outdated.

To keep HubSpot optimized for your Insurtech goals, review your strategy periodically, keeping in mind:

- How often you launch new insurance products or coverage updates

- Shifting customer and broker journey touchpoints

- Your current marketing and sales alignment with insurance distribution channels

- HubSpot’s performance in supporting your insurance sales workflows

- Changes in policyholder engagement patterns and broker relationship management

- Budget for optimization and growth tools in the Insurtech space

Your HubSpot account is your operational hub for insurance innovation. Are you making the most of it to engage new insurance partners, streamline broker onboarding, and retain loyal policyholders?

Spending time crafting your HubSpot strategy for Insurtech can pay off substantially. Wondering what goes into building an effective Insurtech HubSpot strategy? Start here.

You may spend more time building your design plan than you will on the design itself. If you’re wondering what should go into your Insurtech marketing strategy, start here.

How to Build a High-Impact HubSpot Strategy for Insurtech

- Assess data hygiene to ensure your insurance data is clean, organized, and compliant with no duplicates

- Set clear goals that align KPIs with Insurtech growth objectives like policy activation rates and broker engagement

- Define your brand voice and user journeys for consistent touchpoints across the insurance buying experience

- Write targeted messaging that’s personalized for different insurance segments and action-oriented

- Optimize for SEO to drive inbound traffic with search-friendly content targeting insurance buyers and brokers

- Use automated workflows to nurture insurance leads, onboard brokers and policyholders, and upsell additional coverage

- Prioritize leads with scoring to focus on engaged and ready-to-convert insurance prospects

- Organize pipelines so each sales stage aligns with the insurance customer journey from quote to policy

- Build an onboarding workflow that gives new insurance partners and policyholders a seamless start

- Analyze competitors to gain insights from other Insurtech leaders and insurance technology innovators

- Track engagement metrics to continually improve campaign effectiveness in the insurance market

- Set up your CRM for scaling with a structure designed for insurance data management and compliance

- Integrate HubSpot to keep it in sync with your insurance tech stack including policy management and underwriting systems

- Add retargeting pixels to bring insurance prospects back and track engagement across the buying journey

- Drive traffic with targeted ads, email campaigns, and content to attract new insurance leads and broker partnerships

Launch Your HubSpot Strategy for Insurtech Growth Today

Ready to implement and refine your strategy to drive your Insurtech business forward? It can feel overwhelming to juggle setup, optimization, and scaling at once while navigating the complexities of the insurance industry. If you’re looking for guidance, our HubSpot specialists are here to help make your CRM work for you and your insurance innovation goals.

At Digital Star, we don’t just set up your HubSpot account; we design it to help you attract insurance partners, engage brokers, and retain more policyholders. Book a free consultation with our CEO, Alex Moura, and discover how we can help you turn HubSpot into a powerhouse for Insurtech growth.

Our client increased leads by 1,803% and added 4,000+ clients after one year with Digital Star.

“What would it mean if you experienced that kind of growth? Let’s talk.

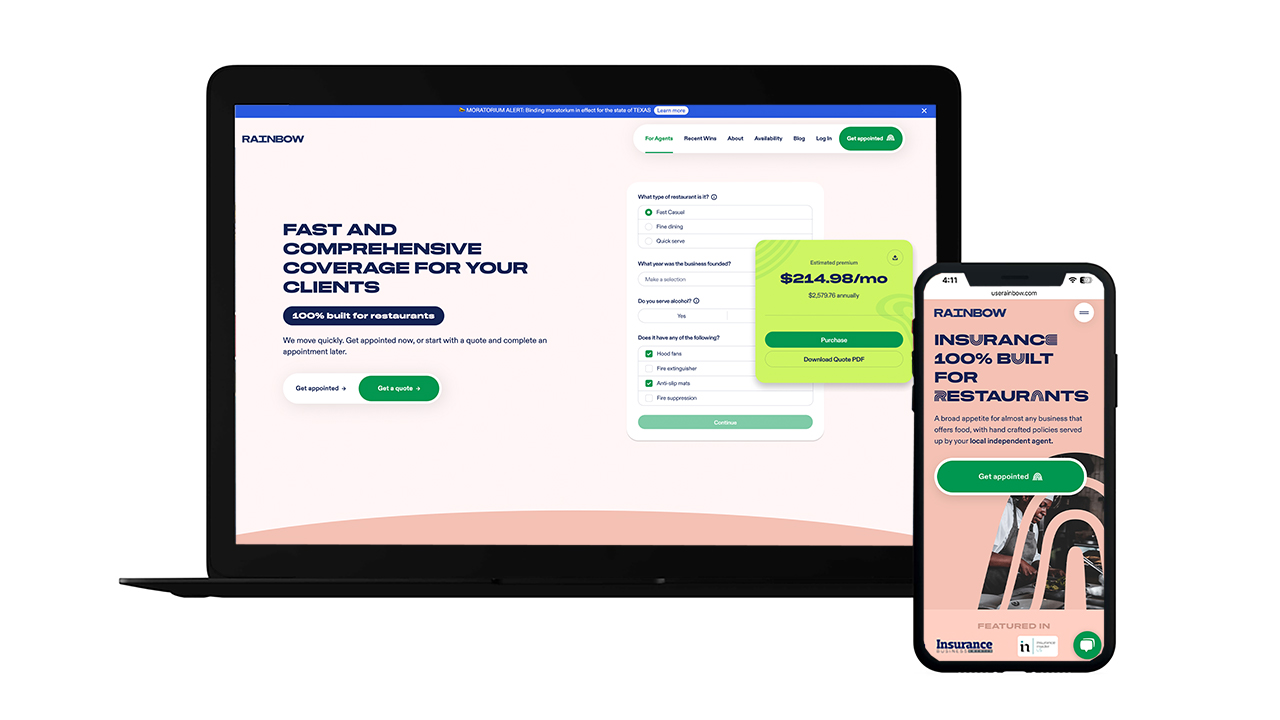

Marketing Portfolio

“Digital Star is a game-changer. They’ve transformed our HubSpot implementation and taken our marketing to the next level. The team’s expertise and attention to detail are unmatched.”

BOBBY TOURAN, CEO & FOUNDER AT RAINBOW

Let’s set up your free consultation.

Fill out the form to speak with our CEO about accelerating your marketing without growing your headcount.

“Digital Star is hands-on, creative and thoughtful at every step!”

Bobby Touran, CEO and Founder at Rainbow